Tesla Earnings Report Revisited: Was the Bearish Call Correct?

A couple of months ago, I analyzed Tesla’s Q4 2024 earnings report and made a bearish call, predicting a post-earnings drop of over 10%, potentially testing the $370 support level. Now, with updated financials and market trends, it's time to revisit that analysis and assess how things played out.

Rafael Villasenor

March 8th, 2025

What Happened After Q4 Earnings?

Tesla's Q4 2024 earnings came in mixed, with revenue slightly beating estimates but EPS missing Wall Street expectations once again. Just as predicted, Tesla’s stock took a hit following the report, dropping 14% in the two days after earnings, briefly touching the $365 range before finding some stability. The key takeaways? Profit margins continued to shrink, and despite a strong revenue report, investors couldn’t ignore rising operational costs, increasing competition, and uncertainty around Tesla’s long-term trajectory.

The biggest concern remains Tesla’s declining profit margins. In Q3 2024, Tesla reported a 21.34% margin, but by Q4, it had slipped further to 19.7%, fueling concerns about how well the company can manage cost efficiency moving forward.

Beyond the numbers, Musk’s public image and controversial political alignments added another layer of uncertainty to Tesla’s stock. The backlash from his comments and growing ties with the Trump Administration created unease among investors, particularly those worried about potential brand reputation risks.

Breaking Down Tesla’s Financials

Here's an updated look at Tesla’s financial metrics following its most recent earnings:

| Quarter | Revenue Forecast | Revenue Actual | EPS Forecast | EPS Actual | Stock Movement |

|---|---|---|---|---|---|

| Q4 2024 | $27.22B | $27.10B | 0.76 | 0.68 | -14% |

| Q3 2024 | $25.47B | $25.18B | 0.59 | 0.72 | +22% |

| Q2 2024 | $24.52B | $25.50B | 0.61 | 0.52 | -12% |

Tesla’s Q4 2024 earnings showed mixed results, with revenue coming in at $27.10B, slightly missing the forecast of $27.22B. However, the bigger issue was profitability, as Tesla’s EPS fell short at $0.68, missing expectations by over 10%. This marks the second consecutive quarter of margin compression, signaling that cost pressures and price cuts are impacting the bottom line.

]Looking at the trend, Tesla’s stock continues to react sharply to earnings reports, moving more than 10% after each announcement. While Q3 saw a 22% stock surge due to a strong EPS beat, Q4’s 14% drop highlights investor concerns over shrinking profit margins, rising costs, and uncertain demand. The key question now is whether Tesla can stabilize earnings growth while maintaining its aggressive expansion strategy.

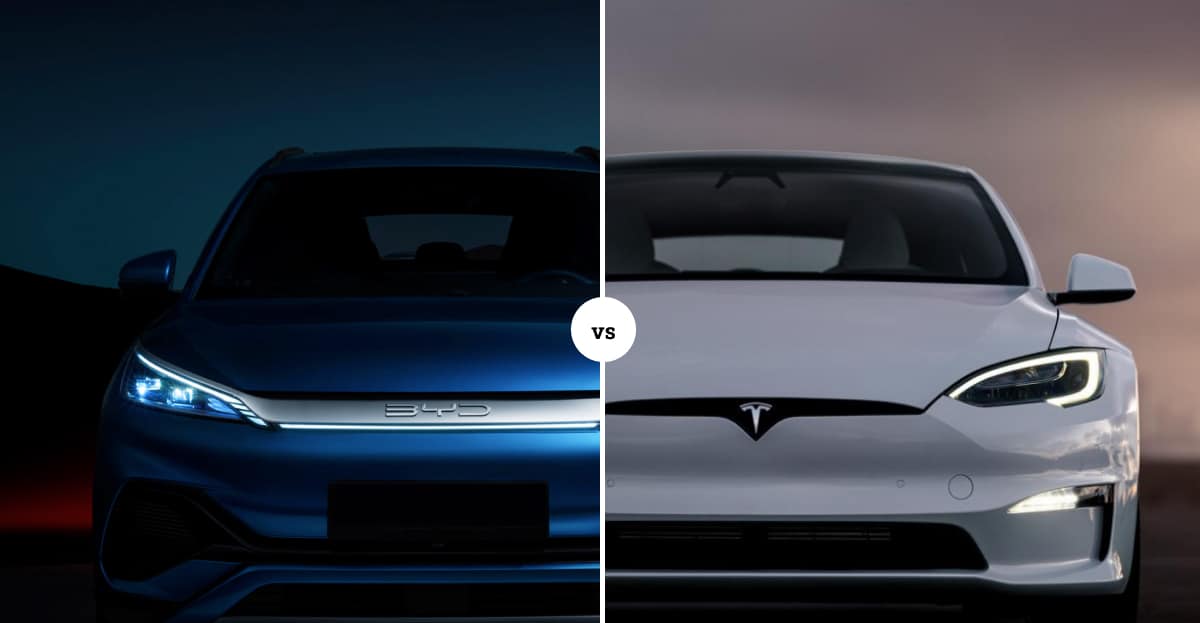

Competition Heats Up

One of the key issues I addressed in my last article was the growing competition from Chinese EV manufacturers, particularly BYD. Since then, the price war has escalated even further, with Tesla slashing prices across multiple models to remain competitive. Yet, BYD continues to dominate in key markets, maintaining a 34% market share in China while aggressively expanding into South America and parts of Europe.

Tesla’s global deliveries slightly declined by 1% to 1,789,000 vehicles, attributed to an aging model lineup and intensified competition, especially in China. Conversely, Chinese automaker BYD sold 1.6 million fully electric cars in 2024, marking a 12% increase and narrowing the gap with Tesla.

Additionally, Tesla’s market share in Norway dropped from nearly 20% in 2023 to 8.8% year-to-date, with new registrations falling 48% in both Norway and Denmark over the first two months of 2025.

Final Thoughts

Based on Tesla’s current price action and overall sentiment, $270 is at risk of flipping into future resistance. If the stock fails to reclaim this level, we could see further downside toward $250 support. Given Tesla’s recent miss on earnings, declining deliveries, and margin compression, there’s a strong chance that bearish momentum will continue in the short term.

If the $250 support breaks, the next key demand zone sits around $230-$240, where buyers may step in. However, if Tesla continues struggling with profitability and market confidence declines further, a deeper correction toward $220 or lower isn’t out of the question.

For any bullish reversal, Tesla needs to break back above $270 and hold that level as support. Until then, the stock remains in a vulnerable position, with further downside likely if macroeconomic conditions and company fundamentals don’t improve.

Bearish Scenario: If Tesla remains weak, expect $250 support to break, leading to a drop toward $230-$240 support.

Bullish Scenario: A reclaim of $270 resistance could open the door for a push toward $300+, but that requires a shift in sentiment and stronger financial performance.